Yes, the current rate tightening cycle has had the desired impact on property prices – successfully cooling the supercharged market to an extent, but buyer beware, things are not as they seem…

Have you stopped to consider borrowing capacity before delaying your purchase?

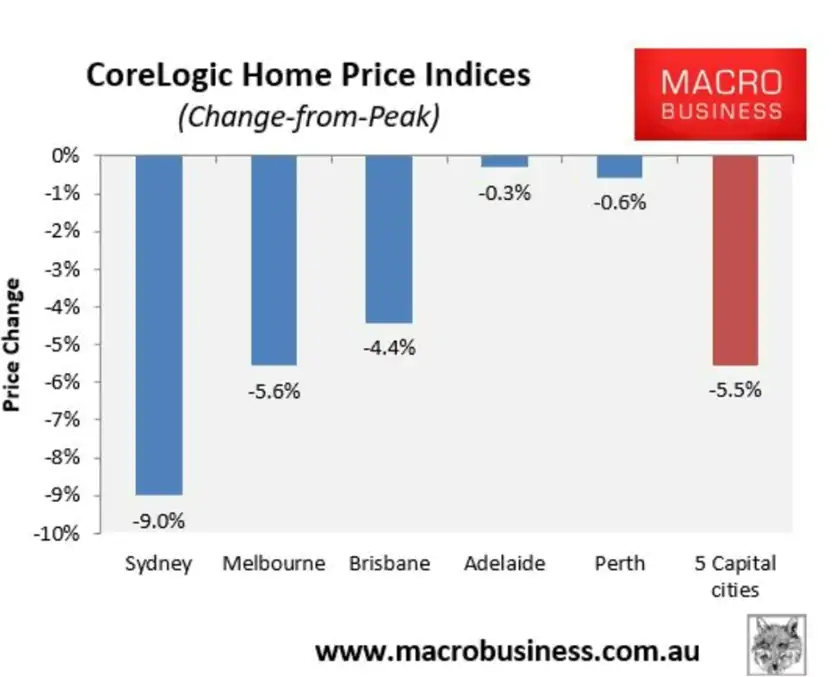

Despite home prices declining by 5.5% nationally across capital cities (Sydney experiencing the biggest decline), that doesn’t mean as a new home buyer, you’re in a better position to purchase a property. Why is this? Significant changes in borrowing capacities – and by significant, we mean they’ll have major impacts on what you want to borrow to get that house your looking for.

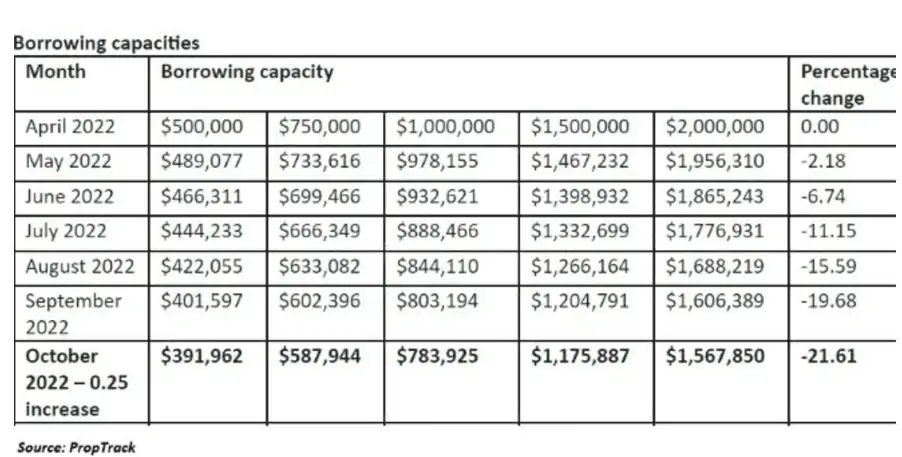

Since April of this year, borrowing capacities have dived by 21%. When you compare this to the declines in property prices (averaged out at 5.5%), if you’re not in the market already, you will struggle to borrow what you may need. The rate rises might have cooled down surging prices, but at the same time, getting access to money for your purchase will be harder than ever.

The table below tells a very sad story about the property market, and it doesn’t just impact first-home buyers, it will affect purchasers of all budgets. If you could borrow $750,000 in April this year, you’re now only able to borrow $587,944. So if you were looking to buy in Brisbane, where the median has soared, think again…

So, you’re probably asking what you need to do if you are/were considering purchasing property over the next year or so. One thing for sure is the rate rises have not stopped – we can expect a few more over the coming months before it does level out and things return to normal (as normal as normal can be).

This poses three realistic options for you as a buyer:

- Purchase now and minimise the further impacts of rate rises on your borrowing capacity. Remember, if you are depositing a more than 30%, you will get better and more competitive rates given the equity/lower LVR you have.

- Keep delaying and see where things end up – with rate rises not expected to stop, borrowing capacity will continue to be impacted. However, more properties may hit the market, and you may find yourself in a position to purchase a bargain.

- Hold until rates start to come down – again, a longer-term strategy but also a viable one.

The best next step you can take is to contact the team at MAW Money. We’ll take the time to understand your situation and recommend a solution best aligned with your current financial situation (and future goals and ambitions.

Contact us today!

Ready to get started? Get in touch with our team today for an obligation-free chat.