As a wave of fixed-rate mortgages mature, Australia is witnessing a surge in refinancing activity. Homeowners are keenly navigating the market, capitalizing on the opportunity to secure loans with more attractive rates. This shift is evidenced by the latest figures from the Australian Bureau of Statistics (ABS), which report a significant volume of refinancing in the property sector.

In August alone, Australians refinanced a staggering $20.60 billion. While this figure represents a slight decrease of 3.9% from the previous month, it marks a considerable 12.4% increase compared to the same period last year. This trend underscores the responsiveness of borrowers to fluctuating interest rates and the compelling offers in the current financial landscape.

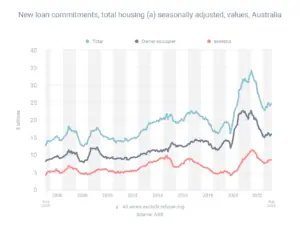

Diving deeper into the ABS data reveals the dynamism of the home loan sector. New home loan commitments saw an uptick of 2.2% in August, reaching $24.82 billion. This growth is not uniform across the board; owner-occupier loans climbed by 2.6% to an impressive $16.07 billion, whereas investment loans also experienced growth, although more modest, with a 1.6% rise to $8.75 billion.

Despite these monthly gains, a broader perspective shows a cooling in the home loan market over the past year:

- Total borrowing has tapered off by 9.4%.

- Loans for owner-occupiers have decreased by 12.5%.

- Investment lending has dipped by 3.0%.

This yearly downturn reflects the broader, more complex economic environment, with variable factors influencing borrower confidence and lender strategies.

The current interest rate climate has evolved considerably, injecting a degree of uncertainty for those holding or considering mortgages. However, this has also stimulated a fiercely competitive mortgage market, brimming with appealing refinancing options. Notably, these opportunities are not limited to the major players; quality smaller lenders are emerging as viable contenders, often offering superior terms to those of well-known, established institutions.

For homeowners and investors, this environment may seem daunting, but it is also ripe with potential. The market is offering a plethora of refinancing deals, some of which could offer significant savings over the life of a loan. Now more than ever, it’s essential for borrowers to conduct thorough research, possibly consult with financial advisors, and consider a broad spectrum of lenders, including the less familiar ones, who may be providing highly competitive rates.

The data tells a clear story: savvy borrowers are on the move, seeking out the best financial options to suit their needs in a changing economic landscape. With such active refinancing, the Australian property market is a vivid tableau of strategic financial planning and a testament to the adaptive nature of consumers in the face of economic shifts.

Ready to get started? Get in touch with our team today for an obligation-free chat.